Financial Advisor

AI Financial Advisor for Tier 2/3 Cities

AI Financial Advisor for Tier 2/3 Cities is designed to bring personalized financial guidance to underserved populations in smaller cities. By analyzing user data—such as income, spending habits, and financial goals—this tool offers tailored advice on savings, investments, loans, and budgeting. It empowers users to make smart financial decisions, even with limited access to traditional financial advisory services.

Limited Access to Financial Advisors: People in smaller cities often lack affordable, personalized financial advice.

Limited Access to Financial Advisors: People in smaller cities often lack affordable, personalized financial advice. Low Financial Literacy: Many individuals are unaware of basic financial planning or investment opportunities

Low Financial Literacy: Many individuals are unaware of basic financial planning or investment opportunities Cultural & Regional Financial Needs: Generic financial tools don’t account for the unique needs of different regions.

Cultural & Regional Financial Needs: Generic financial tools don’t account for the unique needs of different regions. Credit & Loan Accessibility: Limited credit history makes it hard for individuals to access loans or financial services.

Credit & Loan Accessibility: Limited credit history makes it hard for individuals to access loans or financial services.

Personalized Financial Plans: AI provides savings, investment, and debt repayment strategies based on user data

Localized Financial Advice: Tailored advice that considers regional economic conditions and cultural preferences

Smart Loan & Credit Guidance: Helps users understand loan options and improve credit scores through actionable steps.

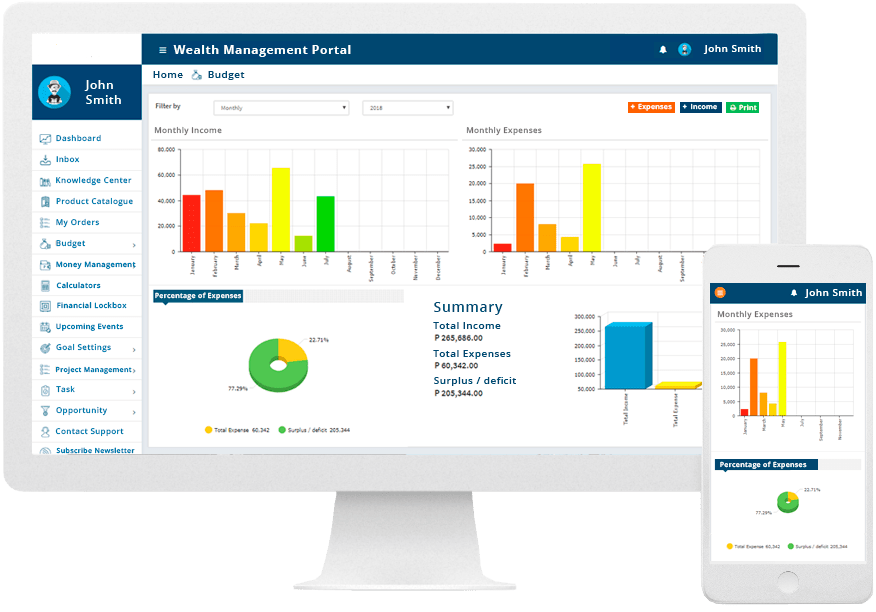

Expense Tracking & Budgeting Tools: Automates tracking of income, expenses, and savings goals for better money management.

Personalized Budgeting

AI generates monthly budgets based on income and spending patterns, with suggestions for savings.

Smart Investment Insights

Tailored investment strategies based on risk profile, financial goals, and regional opportunities.

Debt Management Recommendations

AI provides actionable steps for reducing debts and improving credit scores over time.

Loan & Credit Score Optimization

Guides users through improving their credit scores and accessing affordable loans.

Financial Advisor

Salient Features

Financial Education Hub

Interactive content that improves financial literacy, from budgeting basics to advanced investment tips

Progress Tracker & Goals

Visualize progress on savings, investments, and debt repayment goals

Financial Health Check-Ups

Regular assessments of financial health with suggestions for improvements and adjustments.